Why Cryptocurrency Matters: U.S. National Debt Surpasses $26 Trillion

Cryptocurrency: An Answer to America's Soaring National Debt?

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrency: A Potential Solution for the US National Debt Crisis?

Cryptocurrencies could be a potential solution for the US National Debt Crisis. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Bitcoin is not backed by any government or central institution, and its value is based on how much people are willing to trade it. Bitcoin has been controversial since its creation due to its volatility, which makes it difficult to use as a means of payment.

Other cryptocurrencies, such as Ethereum and Litecoin, were created after Bitcoin. Ethereum is more versatile than Bitcoin, allowing developers to create applications that can run on the blockchain platform. Litecoin is similar to Bitcoin in that it is a digital token that uses cryptography to secure its transactions. However, Litecoin is less volatile than Bitcoin and has a larger user base.

The popularity of cryptocurrencies has led to concerns about their use as a means of payment. Bitcoin has been used for illegal activities, such as buying drugs and weapons, and has been linked to criminal organizations. Additionally, cryptocurrencies are vulnerable to fraud and theft. As a result, many governments have warned their citizens against investing in cryptocurrencies.

Despite these concerns, cryptocurrencies could be a solution for the US National Debt Crisis. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. This makes them immune to government intervention or manipulation.

Cryptocurrencies could also be used to pay for goods and services. Bitcoin has been used to buy goods online and at physical stores, and Ethereum is being used to purchase goods and services. In addition, cryptocurrencies could be used to pay for government services. Ethereum is being used to pay for government services in countries such as Estonia and Switzerland.

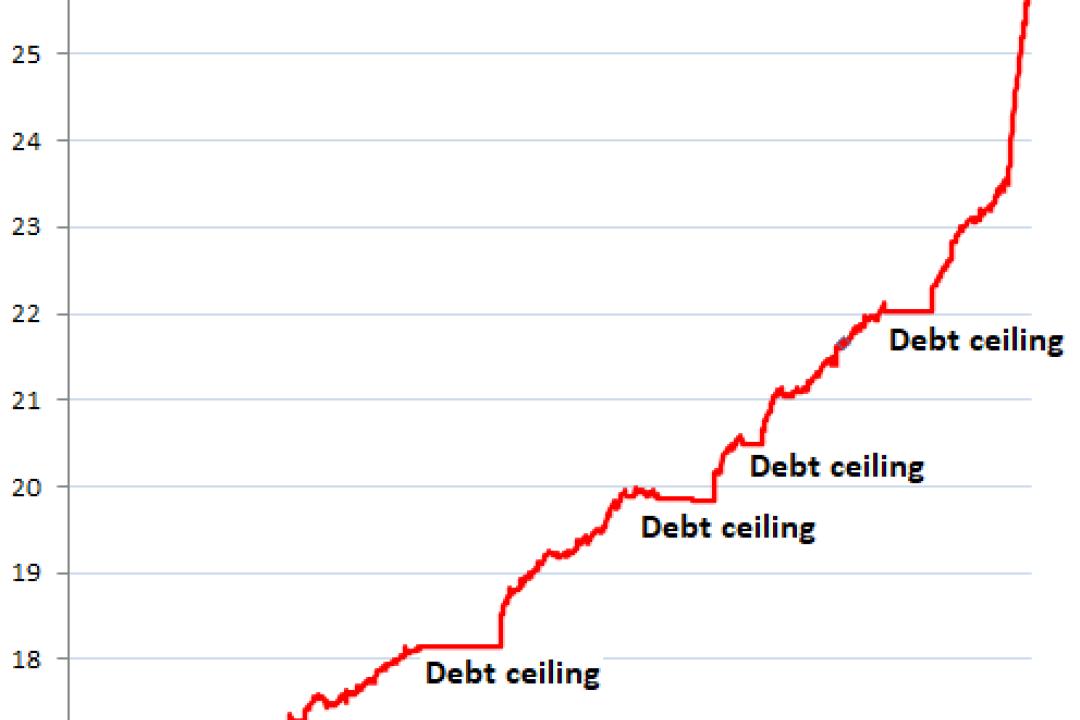

As cryptocurrencies become more popular, they could be used to pay for all types of goods and services. This could help to solve the problem of the US National Debt Crisis. The US National Debt is currently over $20 trillion, and it is growing quickly. If the US National Debt Crisis was not solved, it could lead to economic collapse and widespread social chaos.

By using cryptocurrencies, the US National Debt Crisis could be solved. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. This makes them immune to government intervention or manipulation. Additionally, cryptocurrencies could be used to pay for goods and services. Bitcoin has been used to buy goods online and at physical stores, and Ethereum is being used to purchase goods and services. In addition, cryptocurrencies could be used to pay for government services. Ethereum is being used to pay for government services in countries such as Estonia and Switzerland.

As cryptocurrencies become more popular, they could be used to pay for all types of goods and services. This could help to solve the problem of the US National Debt Crisis. The US National Debt is currently over $20 trillion, and it is growing quickly. If the US National Debt Crisis was not solved, it could lead to economic collapse and widespread social chaos.

Cryptocurrency: The Key to Reducing the US National Debt?

The Cryptocurrency market is booming and it’s no wonder why. Cryptocurrencies like Bitcoin and Ethereum provide an alternative payment system that is decentralized and secure. This has led to the growth of the Cryptocurrency market, which is estimated to be worth more than $800 billion by 2027.

The popularity of Cryptocurrencies has prompted many people to ask if they can be used to reduce the US national debt. The answer, unfortunately, is that there is no one-size-fits-all answer to this question. However, there are a number of reasons why using Cryptocurrencies could be a viable solution to reducing the US national debt.

First, Bitcoin and other Cryptocurrencies are decentralized. This means that they are not subject to government or financial institution control. This could potentially lead to the elimination of government debt, as well as the elimination of financial institution debt.

Second, Cryptocurrencies are not subject to traditional financial institutions. This could lead to the elimination of financial institution debt and the introduction of new forms of debt that are free from traditional financial institutions.

Third, Cryptocurrencies are not subject to inflation. This could lead to the elimination of debt that is based on inflated currency values.

Fourth, Cryptocurrencies are not subject to taxation. This could lead to the elimination of government debt that is based on taxes that are not sustainable in the long term.

Fifth, Cryptocurrencies are not subject to market volatility. This could lead to the elimination of debt that is based on market fluctuations that can be difficult to predict and manage.

Sixth, Cryptocurrencies are not subject to geopolitical risk. This could lead to the elimination of debt that is based on geopolitical risks that are difficult to predict and manage.

Seventh, Cryptocurrencies are not subject to human error. This could lead to the elimination of debt that is based on human error, such as the signing of contracts that are not properly executed.

Eighth, Cryptocurrencies are not subject to fraud. This could lead to the elimination of debt that is based on fraud, such as fraudulent loans or investments.

Overall, there are a number of reasons why using Cryptocurrencies could be a viable solution to reducing the US national debt. However, it is important to remember that there is no one-size-fits-all answer to this question.

Exploring the Role of Crypto in Addressing the US Debt Crisis

Cryptocurrencies have been touted as a potential solution to the US debt crisis, as they offer an alternative payment system that is not subject to government control. Cryptocurrencies allow for the secure and anonymous transfer of funds across borders, which could be particularly useful in circumventing financial restrictions imposed by governments.

Cryptocurrencies could also play a role in helping to stimulate economic activity. They are not subject to the whims of central bankers, and as such, could provide a more stable investment option than traditional currencies. Cryptocurrencies could also be used to pay for goods and services, which would help to stimulate the economy.

However, there are a number of challenges that need to be overcome before cryptocurrencies can be used to address the US debt crisis. First, governments need to accept cryptocurrencies as a legitimate form of payment. Second, there needs to be a robust infrastructure in place to enable the transfer of cryptocurrencies between users. Third, there needs to be a reliable source of cryptocurrency liquidity. fourth, there needs to be a way to store cryptocurrencies securely. Finally, there needs to be a way to use cryptocurrencies to pay for goods and services.

Can Crypto Help Alleviate America's Growing National Debt?

Cryptocurrencies could theoretically play a role in helping to alleviate America's growing national debt. Cryptocurrencies are not backed by any government or central institution, meaning that they are not subject to the same monetary policies and regulations as traditional currencies. As a result, cryptocurrencies could theoretically be used to circumvent government restrictions on the flow of money. This could potentially lead to increased investment in cryptocurrencies and a reduction in America's national debt.

The Impact of Crypto on the US National Debt Problem

Cryptocurrencies are not the only factor that can contribute to the national debt problem. In fact, the national debt problem is a problem that has been caused by a variety of factors. However, cryptocurrencies could potentially play a role in exacerbating the problem.

One reason why cryptocurrencies could potentially contribute to the national debt problem is because they are not legal tender. This means that they cannot be used to pay off government debts. Instead, they are used as a way to purchase goods and services.

This could lead to a number of problems. For example, it could lead to a decrease in the value of the national currency. It could also lead to a decrease in tax revenue. This could lead to a rise in the national debt.

Another reason why cryptocurrencies could potentially contribute to the national debt problem is because they are not regulated. This means that they are not subject to the same rules and regulations as traditional currencies. This could lead to a number of problems.

For example, it could lead to a number of fraudulent activities. It could also lead to a number of financial scams. This could lead to a rise in the value of cryptocurrencies. This could lead to a rise in the national debt.

How Crypto Could Help Reduce America's Rising National Debt

Cryptocurrencies could play an important role in reducing America's rising national debt. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. This makes them an attractive option for investors, who can store their cryptocurrencies in digital wallets and exchange them for other currencies or goods.

Cryptocurrencies have also become popular as payment methods. Bitcoin, for example, is used to purchase goods and services online. The popularity of cryptocurrencies has led some American lawmakers to consider using them to reduce America's national debt.

Cryptocurrencies could play an important role in reducing America's rising national debt.

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. This makes them an attractive option for investors, who can store their cryptocurrencies in digital wallets and exchange them for other currencies or goods.

Cryptocurrencies have also become popular as payment methods. Bitcoin, for example, is used to purchase goods and services online. The popularity of cryptocurrencies has led some American lawmakers to consider using them to reduce America's national debt.

The use of cryptocurrencies could help reduce America's national debt in several ways. First, cryptocurrencies are not subject to government or financial institution control, which means they are not exposed to the same risks as traditional currencies. Second, cryptocurrencies are not inflationary, which means that their value cannot be increased by the printing of new units. Finally, cryptocurrencies are not subject to taxation, which could help reduce the country's deficit.

While the use of cryptocurrencies could reduce America's national debt in the short term, it is unclear whether they will be a long-term solution. There are several challenges that need to be overcome before cryptocurrencies can be widely adopted as a form of currency. These include ensuring that they remain secure and stable, developing a system for exchanging cryptocurrencies between different platforms, and regulating their use.