How many bitcoins exist?

Uncovering the True Supply of Bitcoins

There is no definite answer to this question as the supply of bitcoins is constantly in flux and depends on a number of factors, including but not limited to mining activity, price fluctuations and changes in demand.

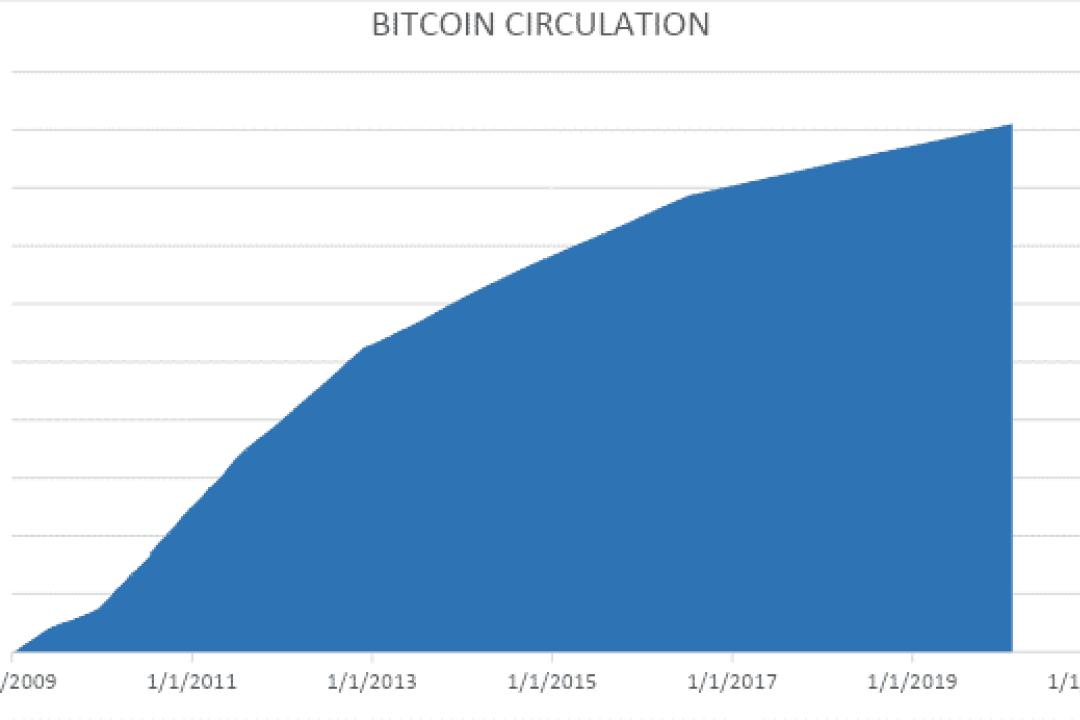

One way to estimate the true supply of bitcoins is to look at historical data and calculate the average number of bitcoins in circulation over a certain period of time. Another way to estimate the true supply of bitcoins is to look at how many bitcoins have been mined over a certain period of time.

What is the Total Number of Existing Bitcoins?

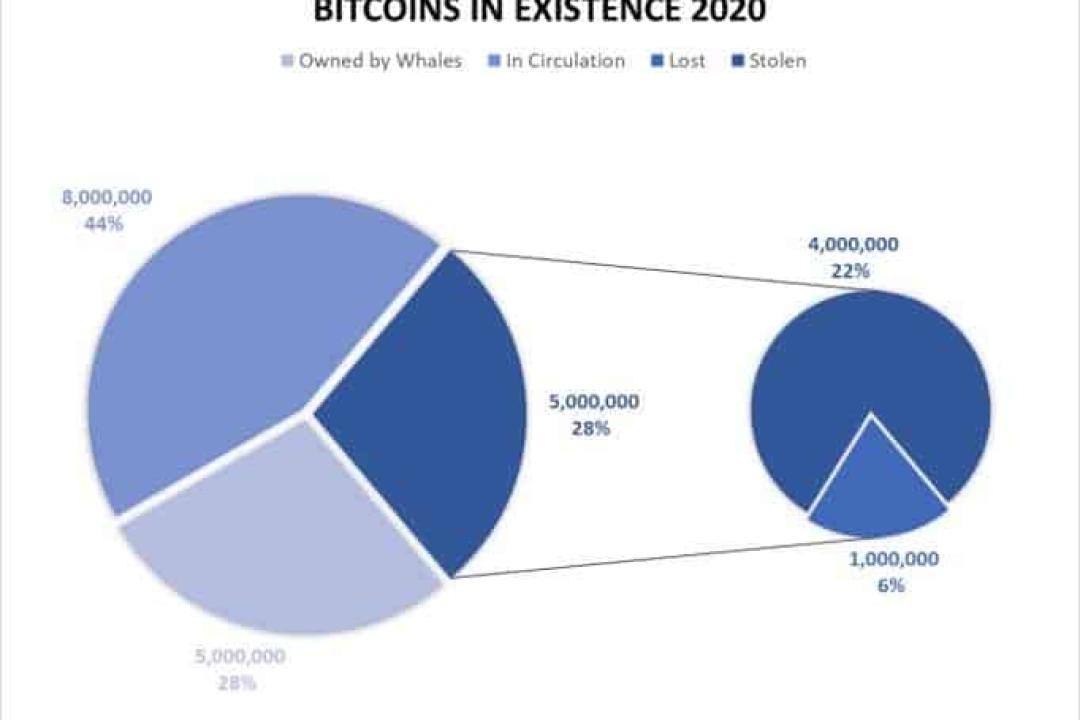

As of January 2018, there are around 21 million Bitcoins in existence.

Exploring the Cryptocurrency's Limited Supply

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Since their inception, cryptocurrencies have faced criticism for their limited supply. Bitcoin, for instance, has a total supply of 21 million units. Ethereum has a total supply of 100 million units. This scarcity has led to high prices and increased demand for cryptocurrencies.

Some policymakers and researchers have called for the creation of a global currency that is backed by gold or other physical assets. Others argue that cryptocurrencies should be regulated and taxed like traditional forms of money. The limited supply of cryptocurrencies will continue to be a source of debate as the technology evolves.

How Many Bitcoin Units Have Been Mined?

As of July 22, 2019, there are about 20.3 million Bitcoin units in circulation.

The Total Number of Bitcoins in Circulation

As of January 2019, there were approximately 21 million bitcoins in circulation.

Analyzing the Impact of Bitcoin's Fixed Supply on Price

One of the most significant features of Bitcoin is its fixed supply. This means that Bitcoin will never have more than 21 million units in circulation. This has a significant impact on the price of Bitcoin, as it ensures that there will never be a massive increase in demand for Bitcoin that could drive the price up significantly.

Examining the Maximum Possible Bitcoin Count

The maximum possible number of bitcoin is 21 million. There are currently about 17.2 million bitcoin in circulation. This means that the maximum possible number of bitcoin is about 2.18 times the current number.

Measuring the Remaining Supply of Bitcoins

The amount of bitcoins that remain in circulation is not a static number. It changes over time as new bitcoins are created and old bitcoins are destroyed.

To measure the remaining supply of bitcoins, we use the following equation:

Remaining Supply = (New Bitcoin Creation Rate * Bitcoin Circulation) - (Bitcoin Destruction Rate * Bitcoin Circulation)

The New Bitcoin Creation Rate is the rate at which new bitcoins are created each day. The Bitcoin Destruction Rate is the rate at which bitcoins are destroyed each day. The Bitcoin Circulation is the total number of bitcoins in circulation.

Investigating the Full Extent of Bitcoin's Presence

Bitcoin is only a fraction of the overall financial system. However, it has become increasingly popular and visible in recent years. There are several ways to investigate the full extent of Bitcoin's presence.

One approach is to look at the number of transactions conducted in Bitcoin. This can give an indication of how prevalent Bitcoin is within the overall financial system. The number of transactions conducted in Bitcoin has grown significantly in recent years. This suggests that Bitcoin is becoming more visible and mainstream.

Another approach is to look at the prices of Bitcoin and other currencies. This can provide an indication of how valuable Bitcoin is relative to other currencies. The price of Bitcoin has soared in recent years, indicating that it is becoming increasingly valuable.

Overall, it appears that Bitcoin is growing in popularity and gaining significant value. This suggests that it has potential to play a significant role within the overall financial system.