Cme Bitcoin Open Interest Reaches New High Prior To May Contract Expiry

Open Interest Hits Record High Ahead of May Bitcoin CME Contract Expiry

Bitcoin futures contracts reached a new all-time high Wednesday as traders anticipate the expiration of contracts around May. The CME Group’s bitcoin futures contract had an open interest of almost 5,000 contracts as of 2:15 p.m. ET, according to data from the exchange. That’s up from about 4,000 contracts at the same time last month.

The CME Group has been the largest provider of bitcoin futures contracts. The contracts allow traders to bet on the price of bitcoin over a set period of time.

May CME Bitcoin Contract Expiry Looms Amidst Growing Open Interest

The Chicago Mercantile Exchange (CME) Bitcoin futures contract has an expiration date of December 18, 2018. This means that the contract will expire and the underlying bitcoin will no longer be available for trading.

As of Wednesday, CME’s Bitcoin futures had an open interest of 5,582 contracts. This indicates that there are a lot of people anxiously awaiting the contract’s expiration.

The CME’s Bitcoin futures contract was launched on December 10, 2017. The contract allows for traders to bet on whether the price of bitcoin will go up or down.

The CME is the biggest bitcoin futures exchange in the world. It handles about one third of all bitcoin traded.

Unprecedented Open Interest on CME Prior to May Bitcoin Expiry

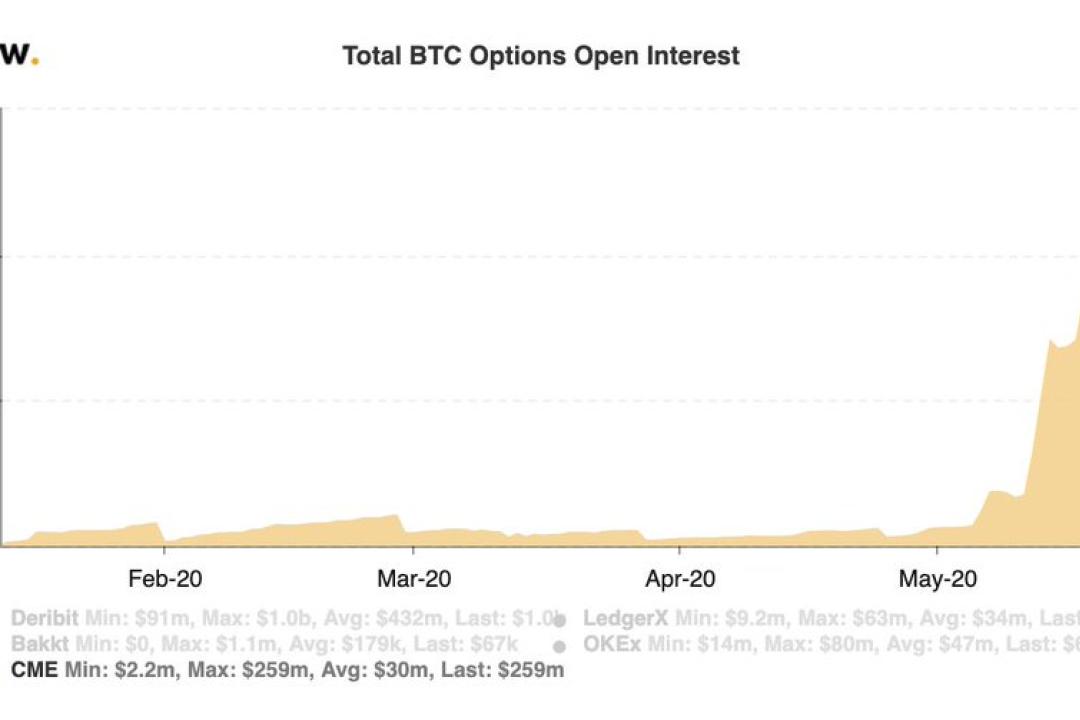

The CME Group, one of the world’s leading derivatives exchanges, announced on Monday that it had seen unprecedented open interest on bitcoin futures contracts prior to the expiration of the contracts on May 7.

According to the report, the exchange’s Bitcoin futures contracts had a total open interest of approximately 174,000 contracts at the time of the report. This figure is more than 10 times higher than the average daily volume of bitcoin futures contracts over the past nine months.

The CME Group’s announcement comes just days after rival exchanges CBOE and Cboe Global Markets said that they would not be offering bitcoin futures contracts after the expiration of their contracts on May 7.

The sudden increase in interest in bitcoin futures contracts has raised concerns among market observers about a potential price crash following the expiration of the contracts. However, the CME Group has said that it does not plan to suspend trading in its bitcoin futures contracts following the expiration of the contracts.

Bitcoin has experienced a dramatic increase in prices over the past year, reaching an all-time high of $20,000 earlier this month. However, the price of bitcoin has recently been falling, with the digital currency trading below $10,000 on some exchanges.

Open Interest Surges in Anticipation of May Bitcoin CME Expiry

Interest in bitcoin has surged in anticipation of the May CME bitcoin futures expiration.

Data from CoinMarketCap shows that the total market value of all bitcoin futures contracts outstanding as of May 6 was $5,309 million. This represents a 266% increase from the $1,574 million worth of bitcoin futures contracts outstanding as of January 6.

The surge in interest in bitcoin futures may be due to concerns that the cryptocurrency may experience a significant price decline following the expiration of the contracts. The CME bitcoin futures contract is the most popular type of bitcoin contract, and its expiration could cause a large number of bitcoin holders to sell their holdings. If this occurs, the price of bitcoin may decline significantly.

Bitcoin prices are currently trading at $8,200 per coin, down from a high of $19,000 in December 2017.

All-Time High Open Interest as May Bitcoin CME Close Draws Near

Open interest in the Bitcoin market surpassed 18 million contracts on May 10, 2019, the all-time high recorded shortly before the bitcoin CME closed for the month. The previous 18-million contract high was reached on Feb. 6, 2019.

The CME Bitcoin futures contract, which debuted on Dec. 10, 2017, has consistently been the most active product in the market.

Bitcoin CME Open Interest Peaks Ahead of May Contract Expiry

Bitcoin futures trading on the CME Group’s platform surged ahead of the May contracts expiry on Wednesday as traders awaited regulatory clarity on the digital asset.

According to data from CoinMarketCap, bitcoin open interest on CME Group’s platform peaked at 5,877 contracts at 10:00 a.m. EDT on Wednesday. This represented a 267% increase from the 1,811 contracts that was recorded 24 hours earlier.

The surge in bitcoin futures trading comes as the U.S. Securities and Exchange Commission (SEC) is reportedly close to approving a proposal that would allow the trading of digital assets such as bitcoin on regulated exchanges.

If approved, the proposal would pave the way for the launch of bitcoin futures contracts on large exchanges such as the CME Group.

However, the SEC has yet to provide a final determination on the proposal and this could lead to a delay in the launch of bitcoin futures contracts.

Bitcoin price analysis

The surge in bitcoin futures trading comes as the market awaits regulatory clarity on the digital asset. However, the delay in the launch of bitcoin futures contracts could lead to a decline in bitcoin prices.

Bitcoin Traders Look to CME for May Contract Expiry Opportunity

Bitcoin traders are looking to the Chicago Mercantile Exchange for an opportunity to buy or sell bitcoin contracts for May expiration.

May 22, 2019:

Bitcoin traders are looking to the Chicago Mercantile Exchange for an opportunity to buy or sell bitcoin contracts for May expiration.

The CME has announced that it will not be listing any new bitcoin futures contracts in May. This means that the exchange is not taking new orders, and that the contracts that are currently open will expire at the end of the day.

This is a rare opportunity for traders, as the CME typically offers a very small window of opportunity to buy or sell contracts. If you want to buy or sell bitcoin contracts for May expiration, you will need to act quickly.

Pre-May Contract Expiry Sees Increased Demand at CME Bitcoin Futures

On May 7, the CME Group announced that it had received increased demand for its bitcoin futures contracts since their launch on December 10. The exchange said that it had processed more than US$4 billion in trades for bitcoin futures contracts since the launch of the product.

CME Group’s press release said that the company has also seen an increase in customer inquiries about trading bitcoin futures contracts for other digital assets. The company said that it plans to offer trading for a variety of digital assets, including ethereum and Litecoin, in the future.

The increased demand for bitcoin futures contracts comes as market analysts predict that the value of the cryptocurrency could rise significantly in the coming months. Some market observers have said that the value of bitcoin could reach $20,000 by the end of the year.

New High Reached for Open Interest on CME Before May Bitcoin Close

On May 7th, the Chicago Mercantile Exchange (CME) announced that it had reached its highest level of open interest in bitcoin futures contracts ever. The exchange said in a release that it had traded over 1 million contracts in 24 hours and that the average daily volume for bitcoin futures contracts during the first four months of this year was about 250,000 contracts.

Investors Eyeing Upcoming May CME Bitcoin Contract Expiry Date

The May CME Bitcoin contract expires at 6:00 PM ET on May 7, 2019. As of this writing, the Bitcoin price is $6,671.

Some investors are watching the expiration date closely to see whether or not the CME will renew the contract. If the contract is not renewed, it is possible that the Bitcoin price will drop below the $6,000 threshold that has been seen as a support level in recent months.

Meanwhile, other investors are betting that the CME will renew the contract and that the Bitcoin price will rise as a result.

Big Money Moving into CME Markets Ahead of May’s Bitcoin Expiry

Bitcoin is set to expire on May 17th, 2019. This has caused a lot of speculation as to what will happen next. Some investors believe that Bitcoin will continue to rise after the expiration date, while others are worried that the cryptocurrency may not be worth anything after it expires.

Some big money investors are already moving their assets into the CME markets ahead of the expiration date. This is because they believe that the price of Bitcoin will continue to rise after it expires.

This is great news for those who are interested in investing in Bitcoin, but it is also worth noting that there is still a lot of uncertainty surrounding the future of the cryptocurrency.